A New Year Reset: Personal Reflections and Smarter Wealth + Tax Moves for 2026

Welcome to the New Year!

I enjoyed year-end celebrations with all four of my daughters around—sometimes. As they’ve grown older, “home” now means quick check-ins between friends, work, and travel. We grab the moments we can and hope to squeeze in family trips this year, though coordinating college, grad school, and post-grad calendars is no small feat.

While we discussed resolutions, I didn’t really put anything down on paper – but I will share here some changes I’m making, and things I’d like to start or re-start in the New Year.

☕️ I’ve replaced my morning coffee and news cycle with coffee and books. Right now, I’m rereading work by Morgan Housel, including The Psychology of Money. His work reinforces something I see every day: wealth decisions are shaped less by intelligence and more by experience, emotion, and behavior.

One of my favorite quotes in the book, which I’ve always followed with and for my clients is, “The most important part of every plan is planning on your plan not going according to plan.”

Our clients receive their bespoke financial portal – where we can visualize all the money puzzle pieces and how they fit together – today, tomorrow, and decades from now. This allows us to constantly adjust our financial plan – as life unrolls. A static, once-and-done financial plan no longer works for complex lives and complex wealth. That is a useless exercise. Our plans live and breathe live, just as we live and breathe.

I often compare my role to the people guiding planes in and out of the gate— you know, the ones with the light sticks. You’re flying the plane. Life pushes you off course. My job is to help guide you safely to the next destination, again and again.

⚽️ My other plans for the New Year – get involved with a local soccer league. I’ve played for years, enjoyed watching all my girls play, and decided I need some more fun and PLAY in my life this year. I put out a request on my local FB group and was immediately put in touch with women who run leagues. Fingers crossed this evolves into some fun matches, with no injuries!

👩🏾🤝👩🏼 I continue to host a local social club I call the “MENS club – no men allowed – Mothers who are Empty Nesters”. We are a group of over 100 women locally, who are all at the same phase of life, more or less. We have more free time in the evenings, and have the energy for more life on our terms. Many of us are in the sandwich generation – taking care of multi-generational families and can support one another in this journey.

I see the same theme with many of my clients— they have more freedom and a desire to be intentional about how they spend their time and energy.

Wealth optimization without tax planning is incomplete planning.

Professionally, tax season is where wealth strategy becomes real. I firmly believe that wealth optimization without tax planning is incomplete planning. Tax laws change constantly, and high-income families have the most to lose—or gain—depending on how proactive they are.

My first Masterclass of the year is coming up, Thursday, January 15, at 12:00 noon ET, and is hosted by an amazing group of women. Their organization is called The Wie Suite, and is a dynamic group of women leaders supporting each other in our careers and more.

✅ Live attendees will receive a code to request a complimentary tax report.

Next up: 2026 Planning Moves High-Income Families Should Be Reviewing Now

1. Set your 401k deferrals to Max Out Workplace Retirement Plans for 2026

Why this matters:

Pretax contributions reduce taxable income now.

The 2026 employee contribution limit is $24,500.

If you’re 50+, you can add a $8,000 catch-up.

Extra special super catch-up for those ages 60 – 63 = $11,250.

For high-earners (wages over $150k), catch-up contributions are made via ROTH, or after- tax contributions. While it does not save you taxes now, it WILL add to your tax-diversification strategy when you start withdrawing funds.

Tip: If your employer offers profit-sharing or after-tax contributions (like the Mega Backdoor Roth), speak with your HR lead to determine how to implement.

2. Traditional and ROTH IRA contributions for 2026

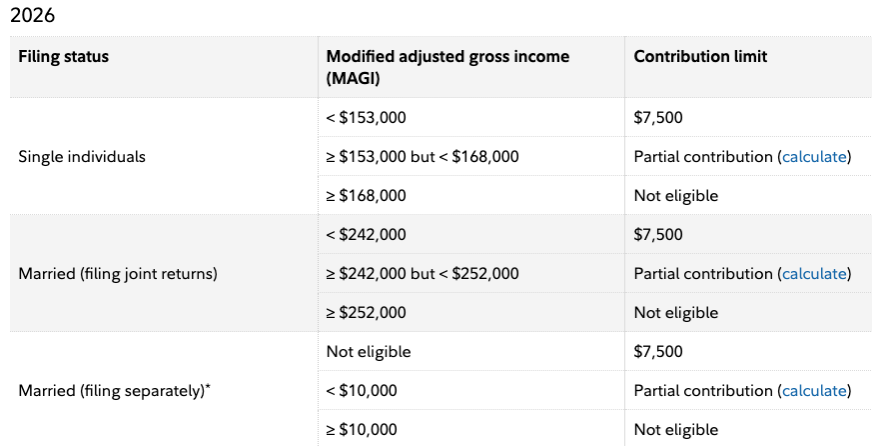

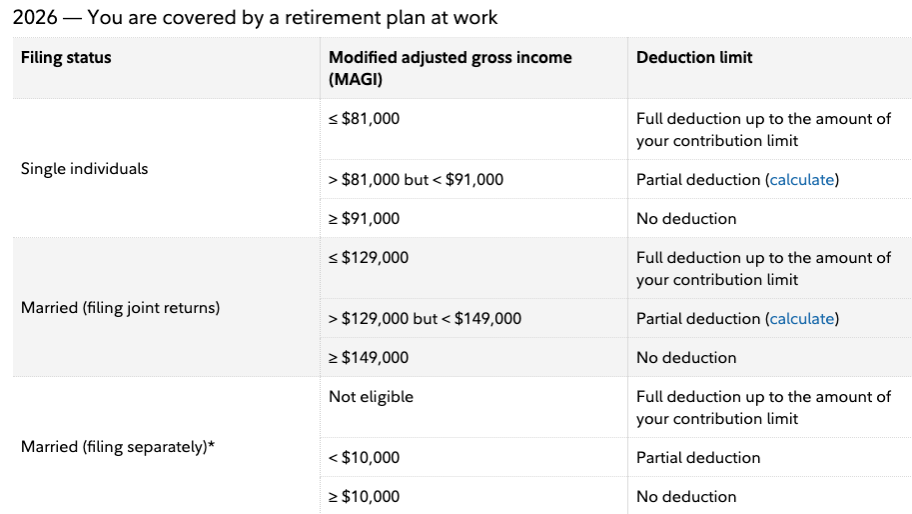

IRA contribution and deduction rules depend heavily on income and whether you’re covered by a workplace plan. For many high earners, direct Roth contributions are unavailable—but planning opportunities still exist through backdoor strategies and conversions.

Roth IRA income thresholds and limits:

Traditional IRA income thresholds and limits – note – the income and deduction limits change if you are/are not covered by a workplace retirement plan:

3. Roth Conversion

A Roth conversion lets you move pre-tax IRA or 401(k) money into a Roth IRA. There is no limit on how much you can convert, but the conversion must be completed by December 31 to be included in your 2026 taxes. There is also no income limits – everyone can consider a Roth conversion. We work closely with our clients as we plan out various tax scenarios to see if this makes sense.

Key points:

The converted amount is taxed as ordinary income.

Conversions can reduce future RMDs.

High earners should run tax projections to avoid bumping into a higher tax bracket. We can help with this!

Example: If you're in the 24% bracket and have room before hitting 32%, converting just enough to “fill the bracket” can be a smart long-term play.

4. Required Minimum Distributions (RMDs)

Rules have changed, increasing the age at which you MUST start taking RMDs from your retirement plans.

Rules:

If 2026 is your first RMD year, you may delay until April 1, 2027.

BUT delaying means taking two RMDs in 2027, which may push you into a higher tax bracket.

Most inherited IRAs also have strict RMD requirements – including the requirement to completely empty the account by year 10.

AARP has a great RMD calculator you can find it here.

Tip: Your long-term financial plan may suggest that you take larger withdrawals in years 1-9 than required by the IRS. We work closely with our clients to determine the best course of action, and if you’re not thinking about this, get ready for an unexpectedly large tax bill in year 10, when you must completely empty the account.

Further, missing an RMD can trigger a penalty of up to 25% of the amount you should have withdrawn.

5. JANUARY 15, 2026: DON’T MISS THIS DEADLINE

This is one of the most common penalty traps I see for high-income households.

Fourth-Quarter Estimated Tax Payment

If you’re self-employed or receive income without withholding (like RSUs, bonuses, K-1s, rental income, or capital gains), your Q4 estimated tax payment for 2025 is due January 15, 2026.

Checklist:

Review total 2025 income

Calculate remaining tax liability

Make the January payment to avoid penalties

High-income households with volatile income often need this final payment to stay penalty-free.

And much more!

We have a full year of events planned – both live and virtual. Stay tuned from emails from me, as well as my partner firm, SMB Financial Strategies. And we’re always open to your suggestions. Is there something you’d like to learn? Do you or a friend have an expertise you’d like to share? Send your ideas today.

If you’re unsure whether your current strategy fully integrates wealth planning and tax planning, this is a good time to revisit the conversation.

📲 Schedule time to chat today.

And as always, this information should not be construed as personal advice for readers. Always consult with your wealth and tax professionals.

🐝 FAQ: A New Year Reset + Smarter Wealth & Tax Moves for 2026

What does a “New Year reset” actually look like for high earners?

It’s part mindset, part mechanics: reset habits (spending, saving, attention), then lock in the tax moves that compound over decades—retirement deferrals, Roth strategy, RMD planning, and estimated tax discipline.

Why do you say “wealth optimization without tax planning is incomplete planning”?

Because taxes drive real-world results. A strategy can look great on paper and still fail if withholding, estimated payments, conversions, RMDs, and timing aren’t coordinated. Integrating both helps reduce surprises and improves long-term flexibility.

What are the key 401(k) contribution numbers to know for 2026?

For 2026, the employee deferral limit is $24,500. If you’re 50+, you can add a $8,000 catch-up. Ages 60–63 may be eligible for a higher catch-up of $11,250 if your plan allows it.

I’m a high earner — do my catch-up contributions have to be Roth in 2026?

Often, yes. For many plans, higher-wage participants are required to make catch-up contributions as Roth (after-tax). Your HR/plan administrator should confirm how your plan implements the rule and what counts as “wages” for the threshold.

What should I ask HR if I want to use the Mega Backdoor Roth?

Ask whether your plan allows (1) after-tax contributions beyond the employee deferral limit and (2) either in-plan Roth conversions or in-service rollovers. If yes, ask the exact steps and how often conversions/rollovers can be done.

What’s a Roth conversion, and what’s the 2026 deadline?

A Roth conversion moves pre-tax IRA/401(k) dollars into Roth (after-tax). There’s no dollar limit on how much you can convert, but conversions must be completed by December 31 to count for that tax year. Projections help avoid an accidental bracket jump.

What’s the biggest RMD “gotcha” to plan around?

If it’s your first RMD year, you may be allowed to delay the first withdrawal into the following year—but that can force two RMDs in one year, which can spike taxable income. Missing an RMD can also trigger a penalty based on the shortfall.

What’s the January 15 deadline you called out — and who does it affect?

January 15, 2026 is the due date for the 4th estimated tax payment for tax year 2025 for many people who make quarterly estimates. It often hits households with income not fully covered by withholding (bonuses, RSUs, self-employment income, K-1s, rentals, capital gains).

What’s the simplest first step to make these moves stick?

Start with one system change: confirm 2026 payroll deferrals (401(k)/HSA), then schedule a tax projection check-in for conversions, RMD strategy, and estimated payments. One strong setup step early prevents scrambling later.