❤️ Love, Taxes, and Long-Term Planning: A February Financial Checklist

February always brings two things into focus: love and taxes.

Valentine’s Day is about the people we care about most. Tax season forces us to slow down and look closely at our financial lives. Together, they create a natural moment to check in — not just to file a return, but to make sure the bigger picture still makes sense.

This February note is meant to do three things:

1. Reduce stress around the 2025 tax filing season

2. Flag important changes that matter for 2026 and beyond

3. Encourage proactive planning, not last-minute decisions

Think of this as a financial tune-up — not a to-do list you need to conquer in one sitting.

Already Working with a Tax Professional? Here’s How to Get the Most Value out of your Relationship.

If you already work with a tax professional you trust, one of the most helpful things you can do right now is complete the tax organizer they send you — whether it arrives digitally or by mail.

Organizers are not busywork. They serve a real purpose. They allow your tax preparer to cross-check what you report with the documents you submit, identify missing information early, and confirm eligibility for deductions or credits that might otherwise be overlooked.

Incomplete or rushed organizers often lead to:

· Missed deductions

· Follow-up requests that slow filing

· Returns that are technically correct but not optimized

Good tax preparation is about accuracy. Great tax planning is about context. The more complete the information upfront, the more opportunity there is to look for planning strategies rather than simply filing what’s already happened.

Are you Looking for a New Tax Preparer? Timing Matters.

If you are considering switching tax preparers, earlier is always better than later.

When I help clients evaluate a new tax engagement, one of the first things we review is the prior year’s return. This provides insight into:

Income sources and complexity

Missed planning opportunities

Carryforwards that may affect future years

Structural issues that deserve attention

I work closely with an experienced, all-female CPA team based in Boston that serves clients nationwide. This integrated approach allows us to coordinate tax preparation with long-term wealth planning — rather than operating in silos.

For clients, that means fewer handoffs, fewer “go ask your CPA” moments, and more clarity around how today’s tax decisions affect future wealth.

We have clients around the country. Schedule your complimentary initial consult here.

Important Tax Season Changes to Know for 2026

IRS Payments and Refunds

The IRS is no longer issuing paper refund checks. When filing, you must provide bank information for either payment or refund processing.

This is a good moment to think intentionally about which account you link. Many clients prefer to avoid using their primary checking account and instead use a designated savings or tax-only account. This reduces risk and helps keep tax transactions separate from day-to-day cash flow.

New Postal Postmark Rules

As of January 1, 2026, mail is postmarked only when it reaches a regional postal processing center — not when you drop it off at your local post office.

This means:

Dropping a return in the mail on April 15 does not guarantee a timely postmark

Mailing deadlines now require more lead time

Late postmarks may result in penalties and interest

If you file by mail, build in several extra days of margin. For some filers, electronic filing or requesting an extension may reduce unnecessary stress.

Thrift Savings Plan Participants – you now have a New Roth In-Plan Conversion Opportunity!

If you contribute to the Thrift Savings Plan (TSP), you are now eligible to complete in-plan Roth conversions.This can be a powerful tool for certain participants, particularly those who:

Expect higher future tax rates

Want to diversify tax exposure in retirement

Have years with temporarily lower taxable income

Roth conversions are not a one-size-fits-all strategy. The timing, amount, and tax bracket impact matter. This is an area where coordination with a tax professional is essential before moving forward.

2026 Tax Planning Guide

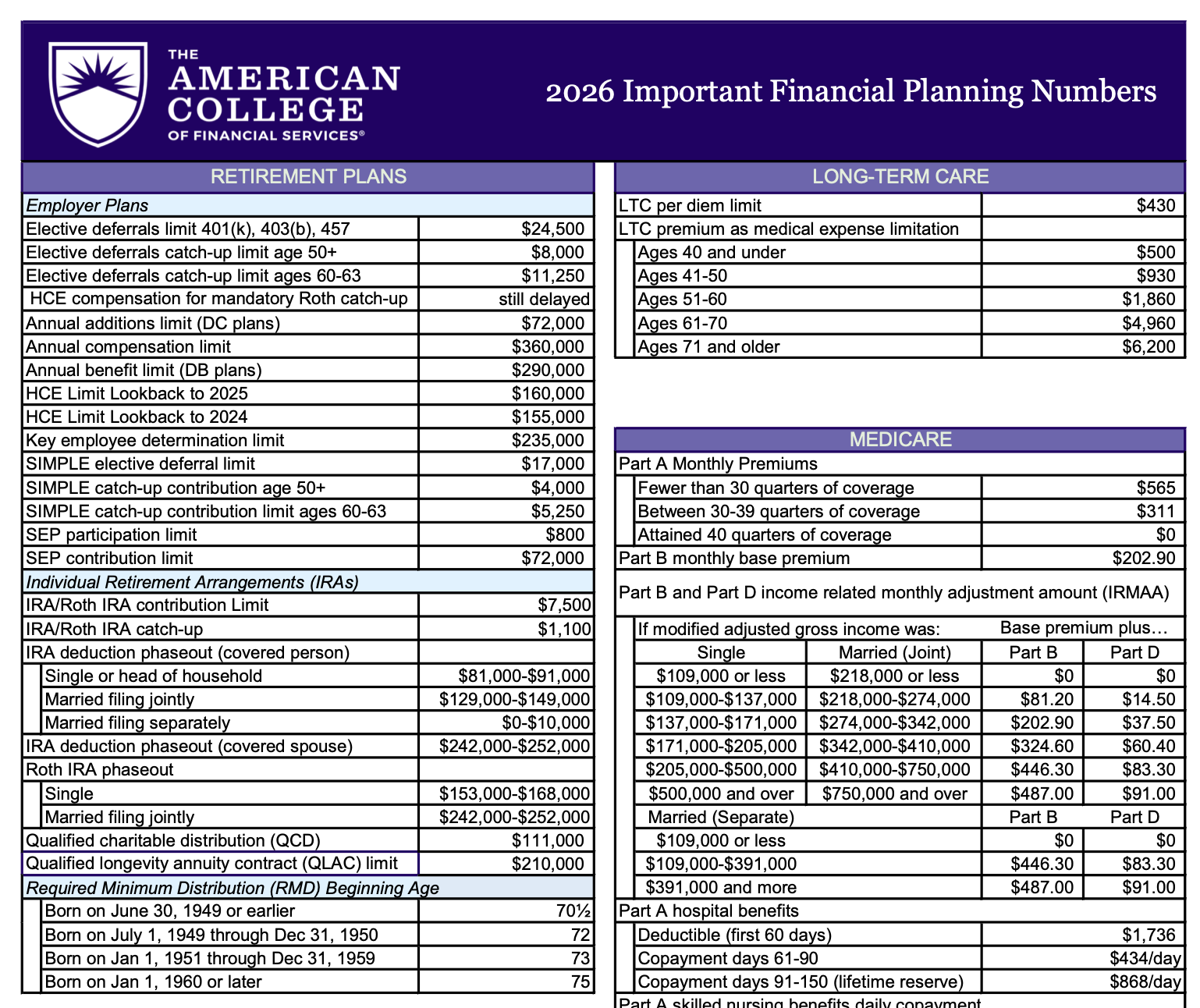

I review a steady stream of tax planning guides, tax updates, and market commentary. The most useful resources are the ones that simplify complex information and put it into perspective. This guide here condenses the important 2026 numbers to know – and it is one page, if you print 2-sided.

❤️ February Is About LOVE, and it is Also About Protection 🔐

February is a natural time to think about protection — not in an abstract way, but in real terms. In my practice, I often see that for many high earners, insurance planning hasn’t kept pace with income growth or life changes. I often recommend reviewing:

1. Term life insurance for income replacement.

2. Private disability insurance to protect earning power.

3. Permanent life insurance for long-term planning and tax-advantaged access to accumulated cash value.

4. Long-term care insurance – in our later years, we typically have rising health care costs. We often discuss having some insurance available to cover our needs and protect our legacy for loved ones and philanthropies.

Of course, in all of the above, health plays a major role in eligibility and cost. The earlier the discussion begins, the more options tend to be available. See below for our upcoming health and wellness webinar we’re happy to share!

And reminders – do not forget to set your 401k paycheck deferrals to max out your workplace retirement plan contributions for 2026.

Why this matters:

Pretax contributions reduce taxable income now.

The 2026 employee contribution limit is $24,500.

If you’re 50+, you can add a $8,000 catch-up.

Extra special super catch-up for those ages 60 – 63 = $11,250.

For high-earners (wages over $150k), catch-up contributions are made via ROTH, or after- tax contributions. While it does not save you taxes now, it WILL add to your tax-diversification strategy when you start withdrawing funds.

Tip: If your employer offers profit-sharing or after-tax contributions (like the Mega Backdoor Roth), speak with your HR lead to determine how to implement.

📆 What’s Ahead

We have a full year of live and virtual events planned. Education remains a core part of how we support clients and the broader community.

If there is a topic you would like covered, or if you or someone you know has expertise worth sharing, I welcome your ideas.

And if you are unsure whether your current strategy fully integrates wealth planning and tax planning, February is a good time to revisit that conversation.

🐝 FAQ: Love, Taxes and Long-Term Planning for High Earners

What’s the point of a February financial checklist?

It’s a quick “tune-up” month: reduce stress during tax season, flag rule changes that affect 2026 planning, and tighten protection planning (insurance + risk coverage) so your long-term plan stays aligned.

If I already work with a tax preparer, what’s the fastest way to get better results?

Complete the tax organizer fully and early. A complete organizer helps your preparer cross-check documents, spot missing items sooner, and confirm deductions or credits that can get overlooked when things are rushed.

When is the best time to switch tax preparers?

Earlier is better. Switching early gives time to review last year’s return, understand carryforwards, and fix structural issues before deadlines get tight.

Are paper IRS refund checks going away?

The IRS has generally stopped issuing routine paper refund checks after September 30, 2025, with limited exceptions. For many filers, that makes bank information part of a smoother filing and refund process.

If I don’t include direct deposit info, what happens to my refund in 2026?

The IRS can still process the return, but may temporarily freeze the refund until you provide direct deposit information or request a paper check.

Which bank account should I link for IRS payments or refunds?

Many households prefer using a dedicated savings or “tax-only” account (instead of their primary checking). It can help keep tax transactions separate from day-to-day cash flow.

What changed about USPS postmarks starting in 2026?

A postmark may be applied later in the mail stream (for example, at a processing facility), not necessarily on the day you drop it off locally. If you mail time-sensitive tax items, build in extra lead time or use methods that give proof of mailing.

What is the new Roth in-plan conversion option for TSP participants?

A Roth in-plan conversion allows you to move money from a traditional (pre-tax) TSP balance to a Roth (after-tax) TSP balance inside the plan. It can help with tax diversification, but it can also increase taxes in the year of the conversion.

What are the 2026 401(k) contribution limits (and catch-up amounts)?

For 2026, the employee 401(k) deferral limit is $24,500. The age 50+ catch-up amount is $8,000. Ages 60–63 may be eligible for a higher catch-up of $11,250 if the plan allows it.

Do high earners have to make catch-up contributions as Roth in 2026?

For certain higher-income participants, catch-up contributions are required to be Roth (after-tax). This is an area where plan rules and IRS guidance matter, so it’s worth confirming with your HR/plan administrator before you change elections.

What protection planning should I review in February?

Common reviews include term life insurance (income replacement), private disability insurance (protect earning power), permanent life insurance for long-term planning in some cases, and long-term care planning. Health and timing can materially affect eligibility and cost.

What is the Mega Backdoor Roth (and when should I ask my employer about it)?

If your workplace plan allows after-tax contributions and in-plan Roth conversions (or in-service rollovers), you may be able to move additional dollars into Roth beyond standard limits. Ask HR what your plan allows and what steps are required to implement.